Key takeaways

- The USD will probably struggle to rally in the weeks ahead, with the Fed likely to extend its easing cycle, a US government shutdown, and US-China trade talks.

- The CAD could gain by tracking the broad USD, while the EUR, GBP, and CHF hold range.

- The JPY may strengthen, with fiscal fears overblown and upside risks around BoJ policy.

Our tactical view

Table of tactical views where a currency pair is referenced (e.g. USD/JPY):An up (⬆) / down (⬇) / sideways (➡) arrow indicates that the first currency quotedin the pair is expected by HSBC Global Research to appreciate/depreciate/track sideways against the second currency quoted over the coming weeks. For example, an up arrow against EUR/USD means that the EUR is expected to appreciate against the USD over the coming weeks. The arrows under the “current” represent our current views, while those under “previous” represent our views in the last month’s report.

USD

We look for the USD to grind weaker in the coming weeks even though the likely easing by the Federal Reserve (Fed) is already priced into markets. Markets expect the Fed to deliver a 25bp cut at its 28-29 October meeting. It will be difficult for the USD to rally when the Fed is easing and most other G10 central banks are on hold or potentially tightening. Uncertainty remains elevated, on a number of fronts but not all point in the same direction for the USD. US trade policy will be a focus with ongoing US-China trade talks, and oral arguments at the Supreme Court on the legality of many of President Trump’s emergency tariffs set to be held on 6 November. Fed independence may also feature as the succession process for Chair Powell moves forward, but Fed easing seems to have curtailed the level of criticism directed at the Fed by the Trump administration. We think all this leans towards USD weakness, rather than strength.

Short-term direction : DXY^

Current

▼ Depreciate

Previous

▶ Track Sideways

EUR

We think it is too early for “fine tuning” arguments at the European Central Bank (ECB) to drive the EUR weaker, but they may cap the upside. Markets expect the ECB to keep rates steady at its 30 October meeting. In France, a new government has been formed, which removes one downside risk for the EUR, namely the uncertainty of a possible fresh election, but the risk of slippage on fiscal austerity targets could weigh on the EUR. Overall, we look for a rangebound EUR-USD and EUR-GBP in the weeks ahead.

Short-term direction : EUR-USD

Current

▶ Track Sideways

Previous

▶ Track Sideways

Short-term direction : EUR-GBP

Current

▶ Track Sideways

Previous

▲ Appreciate

GBP

UK CPI surprise raises the chance of a rate cut by the Bank of England (BoE) at its 18 December meeting to c70% (Bloomberg, 22 October), which could weigh on the GBP. We expect the GBP to hold above the key support level of 1.32 until greater fiscal clarity emerges. In other words, the GBP is likely to hover in a holding pattern ahead of the Autumn Budget on 26 November. The extent of fiscal tightening and the allocation of taxation has the potential to significantly impact economic growth and inflation in the UK. With little space to manoeuvre, political uncertainty fattens the GBP’s tail risks.

Short-term direction : GBP-USD

Current

▶ Track Sideways

Previous

▶ Track Sideways

JPY

We do not expect a possible shift in Japanese fiscal policy to unnerve the currency, as Japan’s new finance minister, Satsuki Katayama, has advocated a responsible approach to fiscal expansion. Some fiscal loosening might help the JPY on the cyclical front if it encourages a more upbeat growth outlook. Markets remain unconvinced that the Bank of Japan (BoJ) could hike on 30 October. Even if the BoJ chooses not to hike immediately, it is possible they would signal greater openness to an 18 December tightening than is currently priced by markets, probably creating upside risks for the JPY. We still see grounds for JPY strength in the weeks and months ahead.

Short-term direction : USD-JPY

Current

▼ Depreciate

Previous

▼ Depreciate

Short-term direction : EUR-JPY

Current

▼ Depreciate

Previous

▼ Depreciate

CHF

The external environment remains an important driver for the CHF, given the Swiss National Bank (SNB) does not meet again until 11 December. A persistent risk-on tone could lead to some pressure on the CHF, but if trade tensions do not fully de-escalate, the CHF is likely to see some safe-haven appeal. As such, we believe the CHF will move sideways over the coming weeks.

Short-term direction : USD-CHF

Current

▶ Track Sideways

Previous

▶ Track Sideways

Short-term direction : EUR-CHF

Current

▶ Track Sideways

Previous

▶ Track Sideways

CAD

For the Bank of Canada’s (BoC) meeting on 29 October, a cut is likely to be accompanied by a hawkish tone, signalling that it is perhaps the last cut in the cycle. If policy is left on hold, the BoC is likely to leave the door wide open to a cut in December. The net result is likely to have limited lasting impact on the CAD, beyond the knee-jerk reaction. With local factors unlikely to get traction, broader USD weakness is likely to see USD-CAD drifting lower in the weeks ahead.

Short-term direction : USD-CAD

Current

▼ Depreciate

Previous

▶ Track Sideways

AUD

A rate cut by the Reserve Bank of Australia (RBA) on 4 November may see the AUD dip briefly, as markets only price in a c65% chance of this happening (Bloomberg, 23 October). However, a weaker USD, alongside a “risk on” mood, should provide an offset. Together, the AUD may stick in a range for now.

Short-term direction : AUD-USD

Current

▶ Track Sideways

Previous

▲ Appreciate

Short-term direction : AUD-NZD

Current

▶ Track Sideways

Previous

▲ Appreciate

NZD

The NZD is the worst performing G10 currency so far in 2H25, losing c6% (Bloomberg, 23 October). After the 50bp easing by the Reserve Bank of New Zealand (RBNZ) on 8 October, markets are fully priced for a further 25bp cut by the RBNZ on 26 November (Bloomberg, 23 October). With a lot in the price, in addition to the help from rising risk appetite, if we are correct to look for broader USD weakness, the NZD looks set to consolidate in the weeks ahead.

Short-term direction : NZD-USD

Current

▶ Track Sideways

Previous

▶ Track Sideways

Note: ^DXY = US Dollar Index, is an index (or measure) of the value of the USD against major global currencies, including the EUR, JPY, GBP, CAD, SEK, and CHF. Source: HSBC

FX Data Snapshot

(from close on 23 September to 23 October*)

FX |

Spot |

200 dma |

1-month % change* |

Support |

Resistance |

|---|---|---|---|---|---|

| DXY | 99.01 | 100.74 | 1.80% | 98.00 | 100.00 |

| EUR-USD |

1.1601 | 1.1282 | -1.81% | 1.1500 | 1.1780 |

| EUR-GBP | 0.8695 | 0.8531 | 0.48% | 0.8630 | 0.8770 |

| GBP-USD | 1.3342 | 1.3222 | -1.36% | 1.3216 | 1.3500 |

| USD-JPY |

152.38 | 147.83 | -3.11% | 150.00 | 155.00 |

| EUR-JPY | 176.77 | 166.70 | -1.31% | 175.00 | 180.00 |

| USD-CHF |

0.7968 | 0.8334 | -0.68% | 0.7873 | 0.8076 |

| EUR-CHF | 0.9244 | 0.9383 | 1.13% | 0.9200 | 0.9300 |

| USD-CAD | 1.3995 | 1.3961 | -1.14% | 1.3890 | 1.4150 |

| AUD-USD |

0.6488 | 0.6434 | -1.68% | 0.6400 | 0.6550 |

| AUD-NZD | 1.1310 | 1.0990 | -0.40% | 1.1190 | 1.1418 |

| NZD-USD |

0.574 | 0.5856 | -2.07% | 0.5650 | 0.5800 |

Note: *As at 09:52 HKT on 23 October 2025.

Source: HSBC, Bloomberg

Explanation of terms

Spot: Spot refers to the current market price of a currency pair that is important for immediate transactions.

200 dma: 200-day simple moving average numberrepresents the average price of an index or a currency pair over the past 200 days.

Support (S), Resistance (R):Support and resistance are significant previous lows and highs plus retracement levels, based on historical price patterns of anindex or a currency pair. Support is a historical price level where a downtrend of a currency pair paused due to demand for the first currency quoted in the pair increasing, while resistance is a historical price level where an uptrend of a currency pair reversed amid demand for the second currency quoted in the pair increasing.

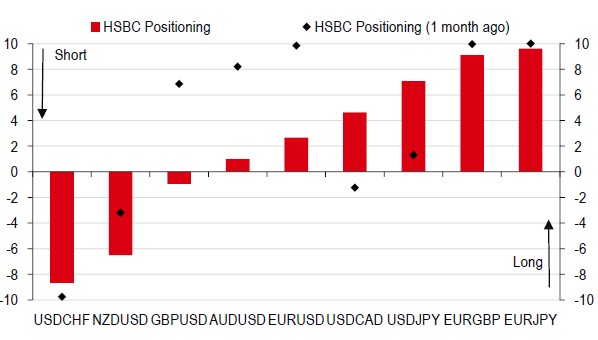

HSBC Positioning Indices

Note: Priced as of market close 22 October 2025.

Source: HSBC, Bloomberg

The indicators have been devised to track the net position of momentum traders, looking at hundreds of strategies, operating over many different time horizons. It considers time horizons of 5 days up to 260 days. An indicator level of +10 would indicate that the hundreds of different strategies have all lined up and gone long (i.e., buy the first currency quoted in the pair). Similarly, an indicator level of -10 indicates that all strategies are short (i.e., sell the first currency quoted in the pair).

Glossary

Dovish

Dovish refers to an economic outlook which generally supports low interest rates as a means of encouraging growth within the economy.

Hawkish

Hawkish is typically used to describe monetary policy which favours higher interest rates, and tighter monetary controls to keep inflation in check.

MoM / YoY

Month on month / Year on year

PMI

Purchasing Managers Index (PMI) is an indicator of economic health of the manufacturing sector (>50 represents expansion vs. the previous month).

IMM data

International Monetary Market (IMM) is a division of the Chicago Mercantile Exchange (CME) that deals with the trading of currencies and interest rate futures and options and the IMM data is part of the Commitments of Traders (COT) reports published by the U.S. Commodity Futures Trading Commission (CFTC). The IMM data provides a breakdown of each Tuesday’s open futures positions on the IMM. Speculative positions are a trader’s non-commercial positions (i.e. not for hedging purposes).

G10

G10 refers to the most heavily traded, liquid currencies in the world: USD, EUR, JPY, GBP, CHF, AUD, NZD, CAD, NOK, and SEK.

Fed / FOMC

Federal Reserve System (US’s Central Bank)/Federal Open Market Committee.

ECB

European Central Bank (Eurozone’sCentral Bank).

BOE

Bank of England (UK’s Central Bank).

BOJ

Bank of Japan (Japan’s Central Bank).

BOC

Bank of Canada (Canada’s Central Bank).

RBA

Reserve Bank of Australia (Australia’s Central Bank).

RBNZ

Reserve Bank of New Zealand (New Zealand’s Central Bank).

SNB

Swiss National Bank (Switzerland’s Central Bank).

Important information

Important disclosures

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments (including derivatives) of companies covered in HSBC Research on a principal or agency basis.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

Additional disclosures

- This report is dated as at 23 October 2025.

- All market data included in this report are dated as at close 22 October 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business.Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

Disclaimer

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group.This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice.

HBAP is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You SHOULD NOT use or rely on this document in making any investment decision or decision to buy or sell currency. You SHOULD consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document.

You SHOULD NOT reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to the US, or any other jurisdiction where its distribution is unlawful.

Greece

In Greece, this document is distributed by HSBC Continental Europe, Greece to its customers for general reference only.

Jersey, Guernsey and Isle of Man

In Jersey, Guernsey and the Isle of Man, this document is distributed to its customers for general reference only by HSBC Bank plc Jersey branch, HSBC Bank plc Guernsey branch and HSBC Bank plc in the Isle of Man.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

Hong Kong

In Hong Kong, this document is distributed by HBAP to its customers for general reference only. HBAP is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use or reliance of this document. HBAP gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document.

Malaysia

In Malaysia, this document has been prepared by HBAP is issued and distributed by HSBC Bank Malaysia Berhad (127776-V) / HSBC Amanah Malaysia Berhad (807705-X) (the "Bank"). The Bank is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result, of arising from or relating to your use of or reliance on this document.

Singapore

In Singapore, this document is distributed by HSBC Bank (Singapore) Limited (“HBSP”) pursuant to Regulation 32C of the Financial Advisers Regulations, to its customers for general reference only. HBSP accepts legal responsibility for the contents of this document, and may be contacted in respect of any matters arising from, or in connection with, this document. Please refer to HBSP’s website at www.hsbc.com.sg for its contact details.

Taiwan

In Taiwan, this document is distributed by HSBC Bank (Taiwan) Limited, [13F/14F No 333, section 1 Keelong Rd, Taipei] to its customers for general reference only. HSBC Bank (Taiwan) Limited is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use or reliance of this document. Clients of HSBC Bank (Taiwan) Limited should contact their relationship manager in respect of any matters arising from or in connection with this document.

United Arab Emirates

In the UAE, this document is distributed by HSBC Bank Middle East Limited (“HBME”) U.A.E Branch, P.O.Box 66, Dubai, U.A.E, which is regulated by the Central Bank of the U.A.E and lead regulated by the Dubai Financial Services Authority. In respect of certain financial services and activities offered by HBME, it is regulated by the Securities and Commodities Authority in the UAE under license number 602004. HBME is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document.

India

In India, this document is distributed for general reference by The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), having its India corporate office at 52/60, Mahatma Gandhi Road, Fort, Mumbai 400 001. HSBC India is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HSBC India gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document and clients should contact their relationship manager in respect of any clarifications arising from or in connection with this document.

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. Incorporated in Hong Kong SAR with limited liability. HSBC India is an AMFI-registered Mutual Fund Distributor of select mutual funds and a referrer of other 3rd party investment products. HSBC India does not distribute or refer investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or any other jurisdiction where such distribution or referral would be contrary to law or regulation.HSBC India will receive commission from HSBC Asset Management (India) Private Limited, in its capacity as a AMFI registered mutual fund distributor of HSBC Mutual Fund. The Sponsor of HSBC Mutual Fund is HSBC Securities and Capital Markets (India) Private Limited (HSCI), a member of the HSBC Group. Please note that HSBC India and the Sponsor being part of the HSBC Group, may give rise to real, perceived, or potential conflicts of interest. HSBC India has a policy in place to identify, prevent and manage such conflict of interest.

For more information related to investments in the securities market, please visit the SEBI Investor Website: https://investor.sebi.gov.in/ and the SEBI Saa₹thi Mobile App. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Issued by The Hongkong and Shanghai Banking Corporation Limited, India. Incorporated in Hong Kong SAR with limited liability. HSBC Bank ARN - 0022 with validity from 19-Feb-2024 to 18-Feb-2027. Date of initial registration: 19-Feb-2002.

United Kingdom In the United Kingdom, this document is distributed by HSBC UK Bank Plc (“HSBC”), 1 Centenary Square, Birmingham BI IHQ United Kingdom which is owned by HSBC Holdings plc. HSBC is incorporated under the laws of England and Wales with company registration number 9928412 and is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Our firm reference number is 765112. HSBC gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this video or the information contained within it.

Australia This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

Miscellaneous Notwithstanding this document is not investment advice, please be aware of the following for the sake of completeness. Past performance is not an indication of future performance. The value of any investment or income may go down as well as up and you may not get back the full amount invested. When an investment is denominated in a currency other than the local currency of an investor, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. Where there is no recognised market for an investment, it may be difficult for an investor to sell the investment or to obtain reliable information about its value or the extent of the risk associated with it.

This document contains forward-looking statements which are, by their nature, subject to significant risks and uncertainties. Such statements are projections, do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from the forecasts/estimates. No assurance is given that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. No obligation is undertaken to publicly update or revise any forward-looking statements contained in this document or any other related document whether as a result of new information, future events or otherwise.

The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates and their respective officers and/or employees, may have interests in any products referred to in this document by acting in various roles including as distributor, holder of principal positions, adviser or lender. The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates, and their respective officers and employees, may receive fees, brokerage or commissions for acting in those capacities. In addition, The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates, and their respective officers and/or employees, may buy or sell products as principal or agent and may effect transactions which are not consistent with the information set out in this document.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED. No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.