4 Mar 2024

2024 has started as 2023 finished, with markets trying to work out when central banks will move towards rate cuts, and how quickly they will then be reduced. On the back of January’s central bank meetings, market interest rate cut expectations may have been pushed back a touch while our forecasts still look for Federal Reserve and European Central Bank rate cuts to start in June, and to be smaller in magnitude than is currently being priced in.

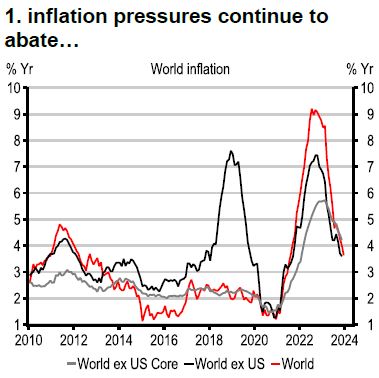

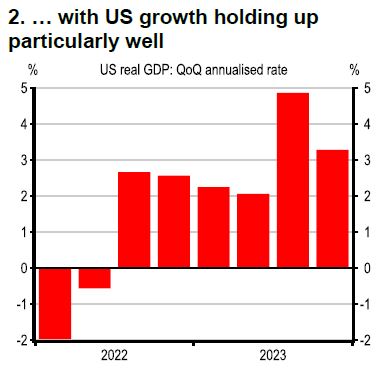

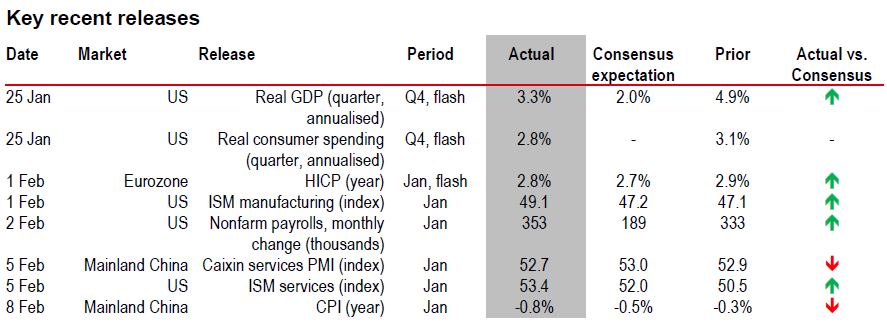

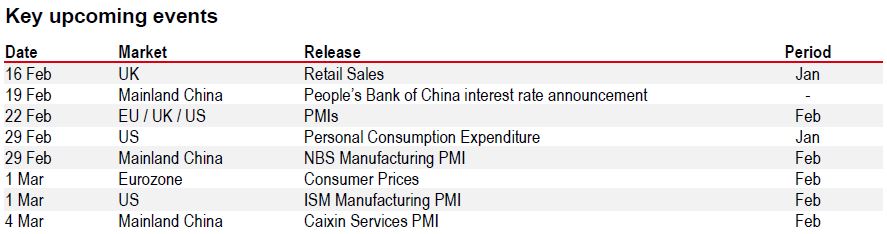

Inflation has come down markedly, particularly over the past six months (see Chart 1), giving room for central bankers to think about easing. But activity data continue to hold up particularly in the US (see Chart 2). The early signs from 2024 suggest economic activity continues to tick along despite the risks to growth from higher rates and geopolitical uncertainty.

As a result, central bankers face a tough balancing act – trimming rates may limit any downside risks to the economy, but it could risk cutting too early and stoking another leg higher in inflation. The ongoing disruption to global shipping poses additional inflation complications, too.

Source: Macrobond

Source: Macrobond

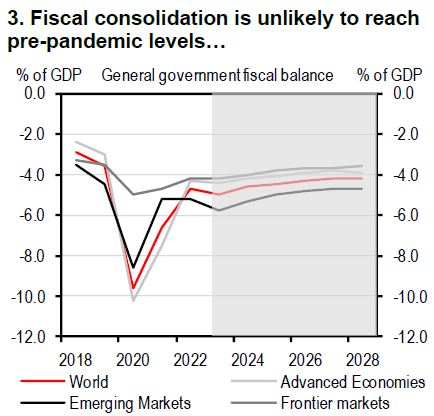

But 2024 isn’t just about monetary policy. As a big election year, fiscal policy is likely to remain close to centre stage. Governments have played a key role in supporting economic growth in recent years, but with higher interest bills and regular spending growth lifted by past inflation, how much is left for incumbent governments to spend?

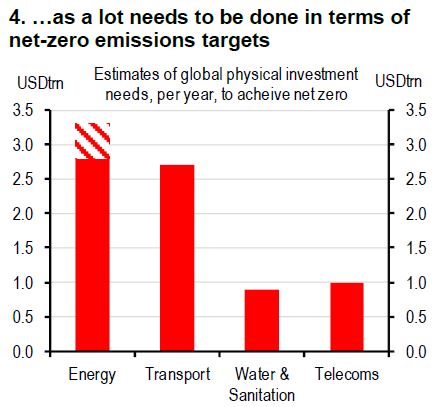

We’re not starting from a favourable position: public debt stands at record high levels. In fact, the World Bank projects global public debt to rise by 1ppt of GDP per year over the medium term (2023-28) with the US and mainland China as the main contributors. And with much spending needed to meet net zero emissions targets, this could lead to debt levels relative to GDP rising by as much as 40-50ppt. Enhancing private sector investments for greener energy and other areas will likely be needed. That means higher tax revenues – especially in emerging markets – will be needed to tame debt levels.

Source: IMF. Note: Shaded region denotes IMF estimates

Source: Grantham Research Institute on Climate Change and the Environment,

Investments for Green Recovery and Transformational Growth 2020–30, June 2021.

Note: Energy estimate is 2.8-3.3 USDtrn pa.

Usually, ahead of elections, we wouldn’t expect the fiscal breaks to be pressed. But with debt issues gathering more headlines in recent months and concerns over fiscal sustainability, we could see incumbent or new governments show more restraint. In the US, for example, the fiscal deficit widened to 6.3% of GDP in 2023 and will likely widen further in 2024 to 6.5%. As a result, investors will be watching for signs of fiscal discipline, not just in emerging markets but in developed economies too.

Source: Bloomberg, HSBC

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: Refinitiv Eikon, HSBC

Additional disclosures

1. This report is dated as at 12 February 2024.

2. All market data included in this report are dated as at close 09 February 2024, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business.Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank Canada, HSBC Bank (China) Company Limited, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (127776-V) / HSBC Amanah Malaysia Berhad (807705-X), The Hongkong and Shanghai Banking Corporation Limited, India, HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

© Copyright 2023. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.